How to Find Warehouse Space in the UK (2025 Guide)

The UK warehouse market is one of Europe's tightest. Vacancy rates below 2%. Properties leasing within days of listing. Rental rates hitting all-time highs.

If you're searching for UK warehouse space using traditional methods, you're competing with one hand tied behind your back. While you're copying property details into spreadsheets, your competitors are touring facilities and signing heads of terms.

This guide shows you exactly how to find warehouse space in the UK efficiently. You'll learn why the golden triangle dominates UK logistics. You'll discover which regional hubs offer the best alternatives. And you'll master search strategies that reduce finding time from 15+ hours to under 2 hours.

This is part of our complete Find Warehouse Space in Europe: Complete 2025 Guide.

The golden triangle provides 4-hour delivery access to 90% of the UK population from a single warehouse location.

Why the UK Warehouse Market is Different

The UK industrial property market operates differently from continental Europe in three critical ways.

Geography concentrates logistics. The UK's relatively compact size (compared to France or Germany) means a single strategically located warehouse can serve the entire nation. This creates intense demand for optimal locations, particularly the Midlands golden triangle.

Continental European logistics typically requires multiple national hubs. The UK needs just one or two facilities for comprehensive coverage. This concentrates demand into specific postcode areas, driving vacancy rates below 2% and creating bidding wars for prime facilities.

E-commerce penetration drives demand. UK online retail penetration is among Europe's highest at 30%+ of total retail sales. E-commerce requires 3x more warehouse space per £1 million revenue than traditional retail. This structural shift creates sustained warehouse demand growth outpacing new supply.

The UK added approximately 18 million square feet of new warehouse space in 2024. E-commerce growth alone consumed 22 million square feet. The gap widens annually, keeping vacancy rates compressed.

Post-Brexit logistics complexity changed UK warehouse strategy. Pre-Brexit, a single EU distribution center could serve the UK and continent. Post-Brexit, customs procedures make this less efficient.

Many operators now run dual inventory strategies: UK warehouses serving British customers, continental warehouses serving EU customers. This increased total UK warehouse demand by 15-20% as companies established dedicated UK inventory holdings.

The Golden Triangle: UK Logistics Heartland

The golden triangle is the UK's premier warehouse location. Understanding why matters for your search strategy.

Geographic definition: The area bounded by Birmingham, Northampton, and Doncaster. More precisely, the region within 50 miles of Coventry, centered on the M1/M6/M42 motorway interchange.

Coverage advantage: From golden triangle locations, you reach 90% of the UK population within 4-hour drive time. London (50 million people within M25) is 90 minutes. Manchester/Liverpool is 90 minutes. Birmingham is immediate. Scotland is 4 hours. Wales is 2 hours.

No other UK region offers equivalent coverage. A warehouse in Manchester serves northern England excellently but adds 2+ hours to London delivery. A facility in London serves the southeast perfectly but adds 2+ hours to northern deliveries.

The golden triangle is the mathematical center of UK population distribution. This isn't marketing—it's geometry.

Transport infrastructure concentration reinforces the advantage. The M1 (north-south artery) intersects the M6 (northwest artery) and connects to the M42 (Birmingham orbital), M69 (Leicester-Coventry), and A14 (Midlands-East coast).

You're never more than 10 minutes from a major motorway in the golden triangle. Compare this to East Anglia, where warehouse locations might be 20-30 minutes from motorway access, or Scotland, where facilities serve regional markets but not national distribution.

Land availability and modern facilities make the golden triangle practical, not just theoretical. Major logistics parks include:

-

DIRFT (Daventry International Rail Freight Terminal): 6.5 million square feet

-

Magna Park (Lutterworth): 7 million+ square feet

-

East Midlands Gateway: 6 million square feet

-

Symmetry Park Kettering: 2.5 million square feet

These parks offer modern facilities with 12-15m ceiling heights, extensive dock configurations, and on-site rail terminals. Continental European-style build quality has become standard in golden triangle developments.

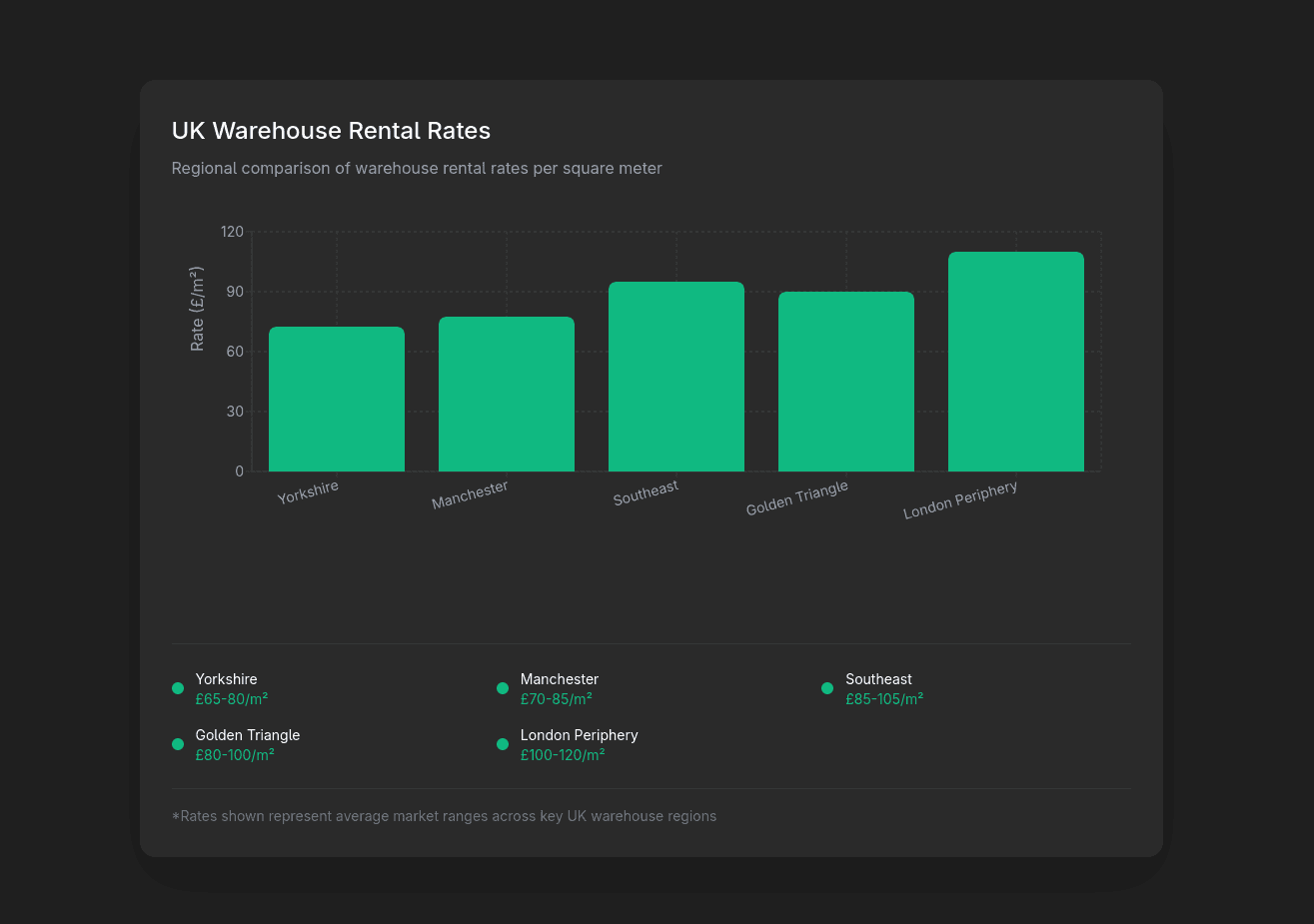

Rental rates reflect demand: Prime golden triangle warehouses command £80-100/m² annually. This is 20-30% premium over regional UK locations but delivers maximum operational efficiency through optimal geographic positioning.

Calculate the trade-off: A £15/m² rental premium on 10,000m² warehouse costs £150,000 annually. But golden triangle location saves 30-60 minutes on 50% of your delivery routes. At 100 deliveries daily, that's 50-100 hours weekly. The transport cost savings exceed the rental premium significantly.

Learn more in our complete Find Warehouse Space in Europe: Complete 2025 Guide.

UK Regional Warehouse Hubs

The golden triangle isn't always the answer. Regional hubs work better for specific strategies.

London periphery (M25 orbital) serves the capital's dense population. Locations in Park Royal, Enfield, Dartford, and Heathrow offer immediate access to 8+ million consumers.

Use London periphery facilities for:

-

Last-mile urban delivery

-

Express/same-day e-commerce fulfillment

-

High-value goods requiring proximity to Heathrow Airport

-

Serving London-centric customer base

Rental rates: £100-120/m² (40% premium over golden triangle). Tight supply—vacancy rates below 1%. Properties typically smaller (5,000-15,000m²) than golden triangle mega-distribution centers.

Manchester/Northwest serves northern England and Scotland. Locations around M60 orbital (Trafford Park, Bolton, Warrington) provide strong regional coverage.

Use Manchester facilities for:

-

Northern England regional distribution

-

Scottish market access (4-hour delivery to Glasgow/Edinburgh)

-

Lower cost alternative to golden triangle (£70-85/m²)

-

Regional players not requiring national coverage

Manchester offers excellent labor availability and lower operating costs than Midlands. But you sacrifice southern England coverage speed.

Yorkshire (Leeds/Doncaster) sits at the northern edge of the golden triangle. Strong manufacturing heritage creates skilled industrial workforce.

Use Yorkshire facilities for:

-

Northern bias distribution (stronger than golden triangle for Scotland/Northeast)

-

Manufacturing-adjacent warehousing

-

Cost-efficient alternative to core golden triangle (£65-80/m²)

Doncaster, specifically, offers rail freight advantages through iPort Rail terminal connecting to Immingham and Felixstowe ports.

East Midlands (Nottingham/Leicester) overlaps with golden triangle but offers distinct characteristics.

Use East Midlands facilities for:

-

East coast port access (via A14 to Felixstowe)

-

Fashion/apparel logistics (strong cluster around Castle Donington)

-

Aviation logistics (East Midlands Airport cargo hub)

Southeast (M4/M3 corridors) serves southern England and provides port access to Southampton.

Use Southeast facilities for:

-

Southampton port import/export operations

-

Western Europe access (Portsmouth-France ferries)

-

London western suburbs coverage

Rental rates: £85-105/m². Less warehouse availability than golden triangle but strategic for specific supply chains.

Prime warehouse rental rates vary by 45% across UK regions, from £65/m² in Yorkshire to £120/m² in London periphery.

Brexit Implications for UK Warehouse Strategy

Post-Brexit logistics changed UK warehouse location strategy. Here's what matters.

Customs clearance locations gained importance. Pre-Brexit, goods flowed freely between UK and EU. Post-Brexit, customs declarations and checks apply to EU-UK movements.

This creates demand for warehouse locations near major ports:

-

Dover/Folkestone: Channel Tunnel and ferry routes to France

-

Felixstowe: UK's largest container port (42% of container traffic)

-

Southampton: Deep-sea port with roll-on-roll-off ferry services

-

Liverpool: Irish Sea access and Atlantic trade routes

-

Immingham/Hull: Northeast ports serving Scandinavia and Northern Europe

Facilities within 30 minutes of these ports enable:

-

Rapid customs clearance and release

-

Minimize dwell time for time-sensitive goods

-

Consolidation/deconsolidation before onward UK or EU distribution

Dual inventory strategies became common. Many operators now maintain separate UK and EU inventory pools rather than single EU inventory serving both markets.

This doubled warehouse requirements for UK-EU operators. A company previously needing one 20,000m² EU distribution center now needs 12,000m² UK facility plus 15,000m² continental facility.

If you're serving both UK and EU markets, plan for two warehouses. A single facility straddling the border no longer provides the efficiency it did pre-Brexit.

Irish land bridge traffic increased. Goods moving from continental Europe to Ireland previously transited through UK (ship to UK port, drive across UK, ship from Wales/Scotland to Ireland).

Post-Brexit, this route faces double customs clearance (EU-UK, UK-Ireland). Direct EU-Ireland shipping bypassed the UK land bridge, reducing UK port traffic for Irish cargo but increasing direct shipping to Irish ports.

For Ireland-focused distribution, consider facilities in Liverpool or Holyhead (Welsh port) for remaining land bridge traffic, or use direct EU-Ireland shipping routes.

Rules of origin affect manufacturing-adjacent warehousing. Products must meet UK-EU trade agreement origin rules to qualify for tariff-free trade. This increases demand for UK-based manufacturing and associated component warehousing.

Automotive, aerospace, and electronics industries particularly affected. Expect continued warehouse demand growth in manufacturing clusters (West Midlands for automotive, Northwest for aerospace).

UK Warehouse Specifications and Standards

UK industrial property specifications differ from continental Europe in subtle but important ways.

Measurement units: UK market still uses hybrid imperial/metric. Ceiling heights quoted in meters (European standard) but floor areas often quoted in square feet alongside square meters.

Conversion: 1m² = 10.76 square feet. A 10,000m² warehouse = 107,639 square feet.

When searching, verify which unit is being used. Some older listings quote only square feet; calculate metric equivalent for comparison.

Ceiling heights in UK warehouses lag continental European standards slightly. Modern UK facilities offer 10-12m clear height. Continental European warehouses commonly reach 12-15m.

This reflects two factors:

-

Slower adoption of very high-bay racking in UK market

-

Planning restrictions on building heights in some locations

For automated storage or high-density racking, specify 12m+ ceiling height. This eliminates many older UK facilities but ensures future-proof storage density.

Loading dock configurations follow UK pallet movement patterns. Standard UK pallets (1000mm × 1200mm) differ from European pallets (800mm × 1200mm).

UK warehouses typically configure docks for British trailer access (13.6m length, 2.55m width). Most modern facilities accommodate both UK and European trailer types, but verify this if handling continental freight.

Dock density: One dock per 2,000-2,500m² is standard UK practice. This is slightly lower than continental Europe (one per 1,500-2,000m²) reflecting different throughput patterns.

Power supply in UK industrial buildings uses different electrical standards. UK standard is 415V three-phase supply. Continental Europe uses 400V.

This rarely matters for standard warehouse operations but affects some automated equipment designed for continental specifications. Verify compatibility if installing European-sourced automation systems.

Fire suppression requirements under UK building regulations may differ from continental standards. ESFR (Early Suppression Fast Response) sprinklers are becoming standard in new UK warehouses, matching European practice.

Older facilities might have conventional sprinkler systems requiring insurance premium increases. Factor this into total occupancy cost when comparing facilities.

How to Search for UK Warehouse Space Efficiently

Apply these specific techniques for UK warehouse search.

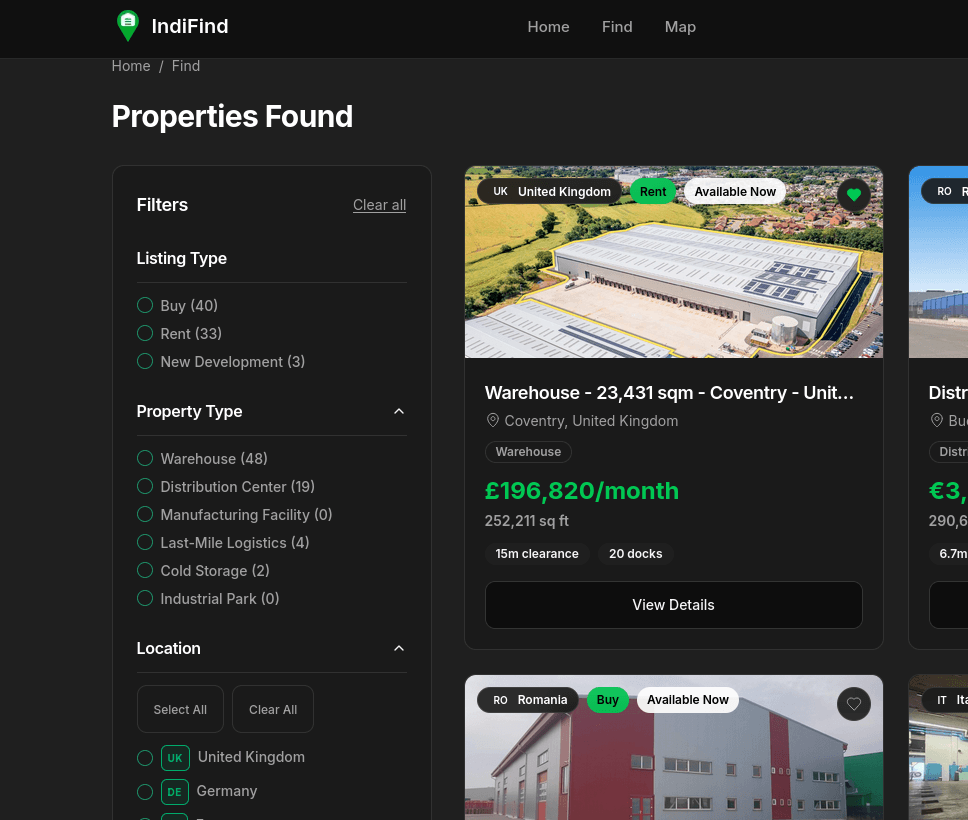

Start with golden triangle focus unless you have specific reasons for alternative locations. Use IndiFind to filter:

-

Location: Leicestershire, Northamptonshire, Warwickshire postcodes

-

Distance: Within 10km of M1, M6, or M42 motorways

-

Ceiling height: 10m minimum (12m for high-bay operations)

-

Docks: Calculate requirement (area in m² ÷ 2,500)

This returns golden triangle facilities meeting modern specifications. Expand search radius if results are too limited.

Set rental rate alerts at £80-100/m² for golden triangle, £100-120/m² for London periphery. Facilities priced below range might have issues (poor condition, limited docks, planning restrictions). Facilities above range are premium specialized assets.

Use route planning to verify coverage from shortlisted locations. On IndiFind, plot your customer concentrations. Draw 4-hour delivery radius circles from potential warehouse locations. Confirm coverage meets your requirements.

A golden triangle facility might show you can reach 92% of customers in 4 hours. A Manchester facility might reach only 70%. The visualization makes the difference obvious.

Include rail-served facilities in your search if handling container volumes of 5+ per week. Rail freight from UK ports (Felixstowe, Southampton, London Gateway) to inland terminals saves 20-40% on road haulage costs.

Major rail-served logistics parks:

-

DIRFT (Daventry): Direct rail connection to Felixstowe and Southampton

-

East Midlands Gateway: Rail terminal with port connectivity

-

Hams Hall (Birmingham): Rail freight interchange

-

iPort Doncaster: Rail-road logistics hub

Filter for "rail siding access" on IndiFind if rail freight is part of your strategy.

Book viewings in clusters. Schedule all golden triangle viewings on the same day. The region is compact—you can view 4-5 facilities in a single day trip. This enables direct comparison while details are fresh.

Don't view Manchester, then golden triangle two weeks later, then London periphery two weeks after that. You'll forget critical details and make comparison difficult.

Engage specialist industrial agents early. UK industrial property market is highly professional. Top agents include Savills, CBRE, JLL, Knight Frank, and Cushman & Wakefield.

Brief your preferred agent on requirements. They'll notify you of off-market opportunities before public listing. In a market with 2% vacancy, off-market opportunities often represent the only available stock.

See our complete Find Warehouse Space in Europe: Complete 2025 Guide for the full systematic search methodology.

UK Warehouse Costs Beyond Rent

Total occupancy cost in UK warehouses includes several components beyond headline rent.

Service charges cover building maintenance, common area upkeep, and facilities management. UK industrial service charges typically run £5-15/m² annually depending on building complexity and shared facilities.

Modern logistics parks with extensive infrastructure (rail terminals, truck parking, gatehouse security) have higher service charges than standalone warehouses. Factor this into cost comparisons.

Business rates (property tax) add significant costs. UK business rates are calculated on "rateable value" (assessed property value) multiplied by a multiplier set annually.

Current rates: Approximately 50-52p per £1 of rateable value. A warehouse with £1 million rateable value pays ~£500,000 annually in business rates.

This is significantly higher than many European countries. Germany, for example, has lower property tax rates. Include business rates in UK-European cost comparisons or you'll underestimate UK total occupancy cost by 15-25%.

Insurance for industrial property runs £0.50-1.50/m² annually depending on contents, location, and building specifications. Modern buildings with ESFR sprinklers and good security get preferential rates.

Older buildings without modern fire suppression might face insurance premiums 2-3x higher than new facilities. Request insurance quotes before committing to older properties.

Utilities vary by operation type. Standard warehouse operations (lighting, heating, minimal cooling) cost £3-8/m² annually. Temperature-controlled facilities cost £15-30/m² for chilled storage, £30-50/m² for frozen storage.

UK electricity costs are higher than most European countries (approximately £0.25-0.35/kWh for industrial supply). Factor this into operating cost projections, especially for automated or refrigerated facilities.

Total cost calculation example:

Golden triangle warehouse, 10,000m²:

-

Rent: £90/m² × 10,000m² = £900,000

-

Service charge: £10/m² × 10,000m² = £100,000

-

Business rates: £50/m² × 10,000m² = £500,000

-

Insurance: £1/m² × 10,000m² = £10,000

-

Utilities: £5/m² × 10,000m² = £50,000

-

Total: £1,560,000 annually (£156/m² total occupancy cost)

Compare only total occupancy costs between options, not headline rents. A facility at £85/m² rent with high service charges might cost more than one at £95/m² with low service charges.

Current UK Warehouse Market Conditions (2025)

Understanding market conditions helps you negotiate effectively and time your search.

Vacancy rates remain below 2% in prime locations. This is structural undersupply, not temporary tightness. E-commerce growth, reshoring, and Brexit inventory duplication create demand exceeding new supply by 20%+ annually.

Expect continued tight conditions through 2025-2026. Properties lease quickly—within 3-7 days of listing in golden triangle locations. This requires fast decision-making and strong negotiating positions.

Rental growth continues at 5-8% annually in prime locations. Golden triangle rents increased from £75-85/m² in 2022 to £80-100/m² in 2025. This trajectory is projected to continue.

Locking in longer lease terms now (7-10 years) protects against future rent increases. Calculate whether longer commitments justify rent certainty.

Speculative development is increasing but not matching demand. Approximately 30 million square feet of new UK warehouse space is under construction for 2025-2026 delivery.

This sounds substantial but represents only 2% of total UK industrial stock. With demand growth at 3-4% annually, supply still lags demand.

Pre-let percentages are high. 70%+ of new developments are pre-let before practical completion. This means truly speculative space (available immediately upon completion) represents only 8-10 million square feet annually.

If you need space in 6-12 months, consider pre-letting new developments. Waiting for completion and then searching means competing for limited available stock.

Investment yields compressed to 3.5-4.5% for prime golden triangle assets. This reflects institutional investor confidence in long-term UK logistics property fundamentals.

For occupiers, tight yields mean strong landlord negotiating positions. Expect limited rent-free periods (3-6 months for new builds, 1-3 months for second-hand) and strong tenant covenant requirements.

Start Your UK Warehouse Search Today

UK warehouse search requires speed and systematic approach in a tight market. Properties lease within days. Rental rates grow 5-8% annually. Vacancy below 2% means limited options.

The seven-step process from our complete European warehouse search guide works perfectly for UK market:

-

Define specifications precisely

-

Focus on golden triangle unless specific regional reasons exist

-

Use specialized filters for ceiling height, docks, motorway access

-

Verify coverage with route planning tools

-

Set automated alerts for new listings

-

Evaluate total occupancy cost (not just rent)

-

Move fast when you find suitable facilities

Start searching UK warehouse space now with IndiFind's specialized industrial property platform. Filter by ceiling height, loading docks, rail access, and transport connectivity across the golden triangle and regional hubs.

Free forever for property seekers. Automated alerts when new properties match your requirements. Route planning tools to verify optimal coverage. Find UK warehouse space in 2 hours instead of 15+ hours of manual searching.

Create your free account and start your UK warehouse search today.

Tags

Read Next

How to Find Warehouse Properties in Europe

Learn how to efficiently find warehouse properties across Europe using supply chain routes, automated alerts, and strategic search techniques.

Industrial Warehouse Specifications: Complete Checklist

A practical, operations-focused checklist of industrial warehouse specifications to lock in before you start touring buildings or talking to landlords.

Warehouse Location Selection Strategy for Europe

A practical playbook for selecting industrial warehouse locations across Europe based on network design, not guesswork.